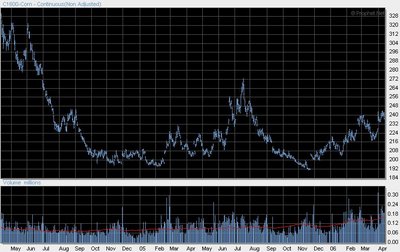

Corn (Maize) is widely cultivated throughout the world and a greater weight of corn is produced each year than any other grain. While the United States produces almost half of the world's harvest, other top producing countries are: China, Brazil, France, Indonesia, and South Africa. Worldwide production was over 600 million metric tons in 2003 just slightly more than rice or wheat. In 2004, close to 33 million hectares of maize were planted worldwide, with a production value of more than $23 billion.

The primary use for corn is as a food or feed for livestock, Corn also has many industrial uses. Some is hydrolyzed and treated to produce corn syrup, a sweetener, and some is fermented and distilled to produce grain alcohol, or ethanol. Grain alcohol from corn is traditionally the source of bourbon whiskey. Ethanol is being used as an additive in gasoline (gasohol) for motor fuels to increase the octane rating, lower pollutants, and reduce petroleum use.

The corn futures are traded at the Chicago Board of Trade (CBOT)

Contract Size is 5000 bushels for the regular future contract and 1000 bushels for the mini future contract, corn options are also available.

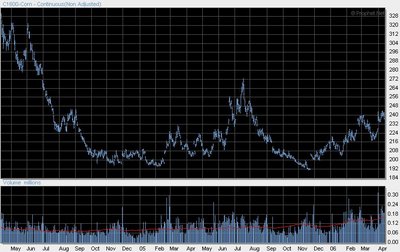

Corn seems to put in a nice double bottom pattern:

50 years chart of corn Futures