The price is quoted at cents per pound; contract size is 37,500 pounds for the full size contract (CK) and 12,500 pounds for the mini size contract (MK).

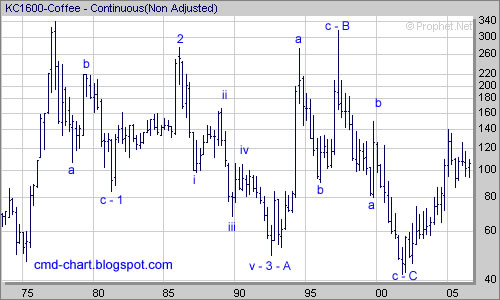

From the long term chart below we can learn that since the first half of 1977 till the second half of 2001 coffee was in a severe bear market and lost about 85% of its price.

Since 2001 Coffee (like so many other commodities)is going up consistently with occasional pullbacks. I think that the 2001 bottom in the price of coffee is significant and technically coffee is positioned for a long bull market.

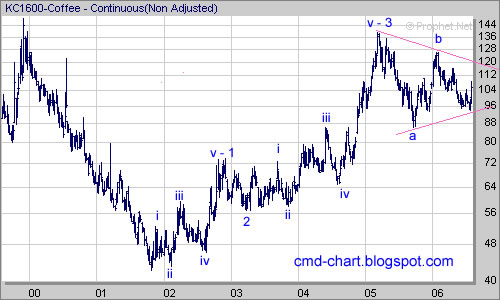

Short term coffee consolidates and forming a symmetrical triangle pattern, a break out one way or another should soon follow. If coffee can break above the (b) high that will indicate that the short term correction is over while a break down below the (a) low will indicate that some more consolidation is required before the continuation of the long term bull market.

No comments:

Post a Comment