Deputy Economic and Trade minister Kirill Androsov said that the international commodities exchange in St. Petersburg will be registered in September or October 2007.

Speaking to journalists in Moscow, Androsov said the exchange would have an initial capital of $US 50 MLN and it would specialise in commodities such as aluminium, timber and metals, and particularly a new Russian export blend crude oil REBCO and oil products.

Leading Russian companies have been invited to participate, with a limit of 10% ownership for founding members.

source

Friday, August 03, 2007

Tuesday, July 24, 2007

Crude Oil update

September Crude Oil (CLU7) bottomed at 54.30$ after topping out at 79.90$.

Still unclear if current level is sustainable.

Resistance between 77$ – 79.90$.

Support between 69$ - 70$.

Crude Oil(CLU7) weekly chart

Still unclear if current level is sustainable.

Resistance between 77$ – 79.90$.

Support between 69$ - 70$.

Crude Oil(CLU7) weekly chart

Monday, July 09, 2007

Platinum, Ready for new highs?

The price of platinum registered a new all time high at May 2006, followed by a three wave correction (A, B, C) . In October 2006 the price bottomed at around 1050$ an ounce and a new rally has begun (primary direction is up so 5 wave pattern is expected). May 2007 another all time new nominal high slightly above 2006 high.

Potential Inverse head and shoulders pattern with 1475$ as initial price objective.

Potential Inverse head and shoulders pattern with 1475$ as initial price objective.

Friday, July 06, 2007

Copper Inventories

As you probably know low stocks equals less supply and thus the price of copper is normally inversely correlated with LME copper warehouse stocks. The LME copper warehouse stocks level are declining consistently since February 2007, already down 50%. Copper stocks are down from about 200,000 to. 105,475 tonne (July 6).

Technically the copper chart looks fine , a-b-c 3 waves correction then an impulsive rally (wave i) , wave iii is currently underway, PPO , RSI up trending bullish. Potential inverted head shoulders pattern with a price objective of 520.

Technically the copper chart looks fine , a-b-c 3 waves correction then an impulsive rally (wave i) , wave iii is currently underway, PPO , RSI up trending bullish. Potential inverted head shoulders pattern with a price objective of 520.

Thursday, June 28, 2007

Tokyo Commodities Exchange to run 24 hours

"Japan’s biggest commodities exchange plans to introduce 24-hour electronic trading. The move by the Tokyo Commodities Exchange is an attempt to attract foreign investors and fend off criticism that it is slowing Tokyo’s drive to become Asia’s leading international financial centre." source

Wednesday, June 20, 2007

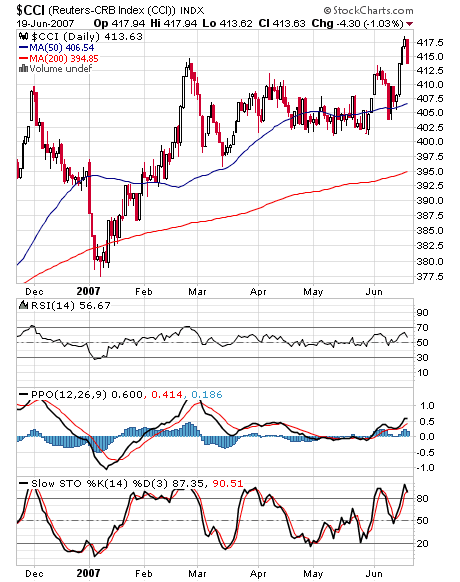

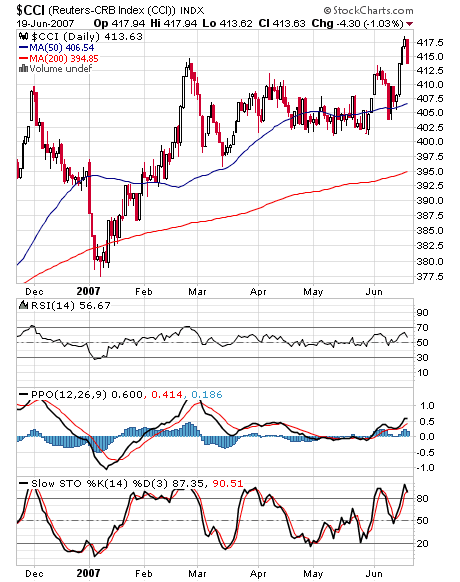

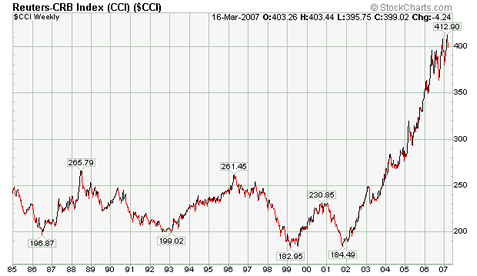

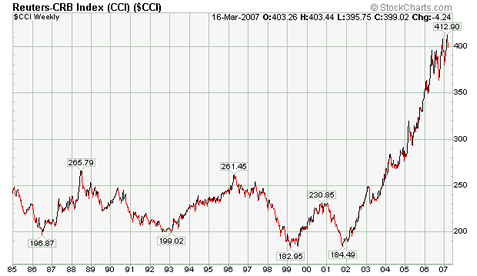

CCI Commodities Index

As previously explained, the CCI is the best barometer available for tracking the condition of the general commodities market. The CCI just made a new bull market high. If you are going to trade this index or any of its components be sure to study each of them both fundamentally and technically!

Long term trend support around the 50 weeks moving average.

Short term trend line support around 402.

Long term trend support around the 50 weeks moving average.

Short term trend line support around 402.

Thursday, May 24, 2007

Uranium Futures (NYMEX: UX)

Uranium futures contracts are currently available for trading on the New York Mercantile Exchange (NYMEX). The new contract was issued early this month and it is tradable on the CME Globex and Nymex clearport systems.

Specification:

Each contract represents 250 pounds of U308

Tick = 0.05$, tick value = 12.5$

Initial Margin for non members is running around 3375$ per contract.

Financially settled, price is based on the UxC index. – You can trade it but can't get the stuff.

According to the NYMEX data, the front month open interest (June 07) is just 17 contracts, a cold start I must say.

Can you put a channel on this chart?

Uranium chart – 5 years

Support around 105$.

Uranium long term chart (37 years)

Specification:

Each contract represents 250 pounds of U308

Tick = 0.05$, tick value = 12.5$

Initial Margin for non members is running around 3375$ per contract.

Financially settled, price is based on the UxC index. – You can trade it but can't get the stuff.

According to the NYMEX data, the front month open interest (June 07) is just 17 contracts, a cold start I must say.

Can you put a channel on this chart?

Uranium chart – 5 years

Support around 105$.

Uranium long term chart (37 years)

Saturday, April 28, 2007

Marc Faber Videos

Marc Faber interview on Bloomberg News. Dr. Faber talk about commodities and global markets. (a bit old but still relevant)

Dr. Marc Faber discusses the current world fiscal situation.

Dr. Marc Faber discusses the current world fiscal situation.

Monday, April 23, 2007

LSE Precious Metals ETFs

In addition to the new SWISS Precious Metals ETF's, Five new physical precious metals ETF's are issued on the London Stock Exchange:

Physical Platinum, LSE code: PHPT

Physical Palladium, LSE code: PHPD

Physical Silver, LSE code: PHAG

Physical Gold, LSE code: PHAU

Physical PM Basket, LSE code: PHPM

source

Physical Platinum, LSE code: PHPT

Physical Palladium, LSE code: PHPD

Physical Silver, LSE code: PHAG

Physical Gold, LSE code: PHAU

Physical PM Basket, LSE code: PHPM

source

Wednesday, April 18, 2007

Producers oppose platinum ETF

Normally one would think that a producer would always be happy to see the product price climbing. According to AngloPlat and Impala Platinum this is not the case…

"Trevor Raymond, head of investor relations at AngloPlat, said the world’s largest platinum producer was opposed to against the launch of a platinum as the fund would put upward pressure on prices and would have a negative impact on jewellery demand."

"Bob Gilmour, investor relations manager at Impala Platinum, the world’s second-largest producer, said it was important to retain a sense of perspective about ZKB’s plans as they did not involve a large amount of platinum but cautioned that the timing of the fund’s launch was poor."

-source

"Given the current market conditions, it's probably not the opportune time to launch a product like this because it's just going to put further upward pressure on the price," said Bob Gilmour, manager of investor relations.

"In the longer term, this is not what you want for demand because it causes attempts at substitution."

_source

Producers have been worried about spikes in platinum prices since that increases the threat of possible substitutions being developed for the metal.

-source

Related :

SWISS Platinum, Palladium & Silver ETFs

Platinum ETF ?

"Trevor Raymond, head of investor relations at AngloPlat, said the world’s largest platinum producer was opposed to against the launch of a platinum as the fund would put upward pressure on prices and would have a negative impact on jewellery demand."

"Bob Gilmour, investor relations manager at Impala Platinum, the world’s second-largest producer, said it was important to retain a sense of perspective about ZKB’s plans as they did not involve a large amount of platinum but cautioned that the timing of the fund’s launch was poor."

-source

"Given the current market conditions, it's probably not the opportune time to launch a product like this because it's just going to put further upward pressure on the price," said Bob Gilmour, manager of investor relations.

"In the longer term, this is not what you want for demand because it causes attempts at substitution."

_source

Producers have been worried about spikes in platinum prices since that increases the threat of possible substitutions being developed for the metal.

-source

Related :

SWISS Platinum, Palladium & Silver ETFs

Platinum ETF ?

Monday, April 16, 2007

Platinum, Palladium & Silver ETFs

Last November it was a bad idea now it’s a good one?

Zuercher Kantonalbank, the biggest of Switzerland's 24 government-controlled cantonal lenders, will launch exchange-traded funds (ETFs) for three precious metals, including platinum, after it launched a gold ETF early last year.

The bank plans to list the new ETFs, based on silver, platinum and palladium, on the SWX Swiss Exchange and trading is scheduled to start on May 10, the bank said in a press release on April 13. The new investment products are designed for wealthy private clients and institutional investors, it said. -source

Price wise it seems like none event for now...

Platinum Spot

Palladium Spot

Zuercher Kantonalbank, the biggest of Switzerland's 24 government-controlled cantonal lenders, will launch exchange-traded funds (ETFs) for three precious metals, including platinum, after it launched a gold ETF early last year.

The bank plans to list the new ETFs, based on silver, platinum and palladium, on the SWX Swiss Exchange and trading is scheduled to start on May 10, the bank said in a press release on April 13. The new investment products are designed for wealthy private clients and institutional investors, it said. -source

Price wise it seems like none event for now...

Platinum Spot

Palladium Spot

Sunday, April 15, 2007

WTI Crude Oil Charts

An Uptrend is an uptrend until proven otherwise – when it breaks.

Log vs. Linear charts comparison:

The three years accelerated uptrend was broken on both linear and log charts.

Log Chart: WTI Crude oil broke down from its five years uptrend but currently trades back above the uptrend.

Linear Chart: WTI Crude oil - the five years uptrend stayed intact.

On the weekly CL chart a noticeable uptrend is in progress.

To recap: The price of crude oil recently pulled back significantly. The five years uptrend was damaged. Technical damage requires technical repair, I opine that it will not be easy for crude oil to climb higher. In case of a break below the 2007 low, 40$ remains the long term bearish target.

Related: Crude Oil Gold Ratio

Log vs. Linear charts comparison:

The three years accelerated uptrend was broken on both linear and log charts.

Log Chart: WTI Crude oil broke down from its five years uptrend but currently trades back above the uptrend.

Linear Chart: WTI Crude oil - the five years uptrend stayed intact.

On the weekly CL chart a noticeable uptrend is in progress.

To recap: The price of crude oil recently pulled back significantly. The five years uptrend was damaged. Technical damage requires technical repair, I opine that it will not be easy for crude oil to climb higher. In case of a break below the 2007 low, 40$ remains the long term bearish target.

Related: Crude Oil Gold Ratio

Thursday, April 12, 2007

Commodity ETF , Now In Italy

ETF Securities to launch 31 Exchange Traded Commodities products in Milan

ETF Securities Ltd, which offers investors access to a range of commodities on multiple exchanges, said it is launching 31 exchange traded commodities (ETC) on the Milan stock exchange, following similar launches in Paris, Frankfurt, Amsterdam and London.

On the new listings, head of listings at ETF Securities Nik Bienkowski said: 'We are enabling investors to tap into the ever-increasing appetite for commodities and to trade easily and cheaply on a single platform.'

The launch of the ETCs on Borsa Italiana, where investor demand has prompted the bourse to create a new specific segment on the ETFplus market, will take place next week and comprise 21 individual securities and 10 index securities.

Among the 21 separate classes of commodity securities are aluminium, brent oil, coffee, crude oil, gold and sugar. The baskets of commodities indices include the ETFS Agriculture DJ-AIGCISM, ETFS Energy DJ-AIGCISM as well as ETFS Industrial Metals DJ-AIGCISM.

ETCs, like exchange traded fund (ETFs), enable investors to trade commodities through ordinary brokerage accounts and can be bought and sold the same day by investors on a regulated exchange in the same way as any equity.

Since Sept 2006, ETF Securities said that assets under management on these 31 ETCs have increased by about 200 pct to over 500 mln usd. The rapid growth in assets highlights the investor demand for easy access to new asset classes, it added.

source

ETF Securities Ltd, which offers investors access to a range of commodities on multiple exchanges, said it is launching 31 exchange traded commodities (ETC) on the Milan stock exchange, following similar launches in Paris, Frankfurt, Amsterdam and London.

On the new listings, head of listings at ETF Securities Nik Bienkowski said: 'We are enabling investors to tap into the ever-increasing appetite for commodities and to trade easily and cheaply on a single platform.'

The launch of the ETCs on Borsa Italiana, where investor demand has prompted the bourse to create a new specific segment on the ETFplus market, will take place next week and comprise 21 individual securities and 10 index securities.

Among the 21 separate classes of commodity securities are aluminium, brent oil, coffee, crude oil, gold and sugar. The baskets of commodities indices include the ETFS Agriculture DJ-AIGCISM, ETFS Energy DJ-AIGCISM as well as ETFS Industrial Metals DJ-AIGCISM.

ETCs, like exchange traded fund (ETFs), enable investors to trade commodities through ordinary brokerage accounts and can be bought and sold the same day by investors on a regulated exchange in the same way as any equity.

Since Sept 2006, ETF Securities said that assets under management on these 31 ETCs have increased by about 200 pct to over 500 mln usd. The rapid growth in assets highlights the investor demand for easy access to new asset classes, it added.

source

Monday, April 09, 2007

The CCI Index

For all practical purposes the Continuous Commodity Index (CCI) is the preferred index for tracking the condition of the general commodities market. The reason for that is the way in which this index is calculated – The CCI Methodology.

5.88% for each of the 17 individual commodities included(Energy 17.64% : WTI Crude Oil, Heating Oil, Natural Gas, Grains 17.64% : Corn, Wheat, Soybeans, Livestock 11.76% :

Live Cattle, Lean Hogs, Softs 29.40% : Sugar, Cotton, Coffee, Cocoa, Orange Juice, Metals 23.52% : Gold, Silver, Platinum, Copper)

Here is the explanation of the CCI Methodology from the NYBOT:

The Continuous Commodity Index (CI)is weighted evenly among 17 component commodities. Each weighting is used for both arithmetic averaging of individual commodity months and for geometric averaging of the 17 commodity averages. With equal weighting, no single contract month or commodity has undue impact on the Index. The CCI uses a system of averaging all futures prices six months forward, up to a maximum of five delivery months per commodity. A minimum of two delivery months, however, must be used to calculate the current price if the second contract is outside the six-month window. Contracts in the delivery period are excluded from the calculation. Although each of the 17commodities is equally weighted, the CCI uses an average of the prices of the 17 commodities and an average of those commodities across time within each commodity. Each commodity is arithmetically averaged across time (the six-month window) and then these 17 component figures are geometrically averaged together. The continuous rebalancing provided by this methodology means the Index constantly decreases exposure to commodity markets gaining in value and increases exposure to those markets declining in value.

5.88% for each of the 17 individual commodities included(Energy 17.64% : WTI Crude Oil, Heating Oil, Natural Gas, Grains 17.64% : Corn, Wheat, Soybeans, Livestock 11.76% :

Live Cattle, Lean Hogs, Softs 29.40% : Sugar, Cotton, Coffee, Cocoa, Orange Juice, Metals 23.52% : Gold, Silver, Platinum, Copper)

Here is the explanation of the CCI Methodology from the NYBOT:

The Continuous Commodity Index (CI)is weighted evenly among 17 component commodities. Each weighting is used for both arithmetic averaging of individual commodity months and for geometric averaging of the 17 commodity averages. With equal weighting, no single contract month or commodity has undue impact on the Index. The CCI uses a system of averaging all futures prices six months forward, up to a maximum of five delivery months per commodity. A minimum of two delivery months, however, must be used to calculate the current price if the second contract is outside the six-month window. Contracts in the delivery period are excluded from the calculation. Although each of the 17commodities is equally weighted, the CCI uses an average of the prices of the 17 commodities and an average of those commodities across time within each commodity. Each commodity is arithmetically averaged across time (the six-month window) and then these 17 component figures are geometrically averaged together. The continuous rebalancing provided by this methodology means the Index constantly decreases exposure to commodity markets gaining in value and increases exposure to those markets declining in value.

Saturday, March 17, 2007

Buy & Hold Commodities?

The DBC commodity ETF was listed on the AMEX at early February 2006, interestingly after a little more then a year the thing has gone nowhere!

Anyone who bought the DBC at the IPO has seen little to no returns while at the same time nimble traders had several long & short trading opportunities.

At the same time (February 2006 – March 2007) the CCI which is a broader commodity index have gained around 10%.

That’s made me thinking - Did Deutsche bank picked the wrong commodities?

Technically:

The DBC is near the 50 / 200 Moving averages and the 50% Fibonacci level. RSI is trending down below 50. The PPO is negative but still above the zero line.

CCI(NYBOT) long term chart

Anyone who bought the DBC at the IPO has seen little to no returns while at the same time nimble traders had several long & short trading opportunities.

At the same time (February 2006 – March 2007) the CCI which is a broader commodity index have gained around 10%.

That’s made me thinking - Did Deutsche bank picked the wrong commodities?

Technically:

The DBC is near the 50 / 200 Moving averages and the 50% Fibonacci level. RSI is trending down below 50. The PPO is negative but still above the zero line.

CCI(NYBOT) long term chart

Wednesday, March 07, 2007

Aluminum Chart (COMEX: AL)

Between the second quarter of 2005 and the Second quarter of 2006 the price of aluminum climbed about 66 cents per pound (0.79$ - 1.45$) for an 83% nominal gain. Note that the price took shape of five wave pattern. According to Elliott waves analysis once a five wave pattern is completed a three wave counter trend should be expected (A, B, C). I estimate that wave (c) is currently underway and a lower low then (a) should follow. The RSI indicator is trending down below 50 and PPO is slightly negative.

Thursday, March 01, 2007

Crude Oil – Update.

Interesting situation, crude May futures contracts are up about 10$ from the year bottom. The price is out of the sharp downtrend but facing horizontal resistance from current level all the way to 66$. (The 50% Fibonacci line).

Tuesday, February 13, 2007

Copper Charts

Copper is one of the most important tradable base metals. The price of copper topped at the second quarter of 2006 after going extremely parabolic and registering an all time high. I have warned about that extreme situation at least two times.

See:

Copper Futures , Comex : HG & Wednesday, May 31, 2006

Copper HG COMEX Futures

One of the most important indicators for the price of copper is the LME stocks levels which seems to bottom and are up more then 100% since mid 2006.

Currently Copper is oversold and I would like to suggest 220 and 190 as important price levels, on the 50 years chart the 145 seems to be the most important price level.

See:

Copper Futures , Comex : HG & Wednesday, May 31, 2006

Copper HG COMEX Futures

One of the most important indicators for the price of copper is the LME stocks levels which seems to bottom and are up more then 100% since mid 2006.

Currently Copper is oversold and I would like to suggest 220 and 190 as important price levels, on the 50 years chart the 145 seems to be the most important price level.

Monday, February 05, 2007

WTI Charts

Dear readers,

Last year I posted several times about 81$ being a price target for profits taking.

See:

http://cmd-chart.blogspot.com/2006/04/crude-oil-futures-cl-chart-update.html

http://cmd-chart.blogspot.com/2006/04/new-all-time-high-for-crude-oil-wti.html

http://cmd-chart.blogspot.com/2006/05/crude-oil-futures-wti-elliott-wave.html

WTI Crude oil contracts topped at July 2006 and broke below the five years uptrend line. Crude bottomed at January 2007 and currently we are witnessing some upside but the downtrend channel is still intact. It is still early to determine if the January bottom is significant or not , using the long term chart as guidance I estimate that a down spike to about 40$ is possible. The 62.5$ - 66$ seems like significant resistance for the March contract. As I see the situation traders should be cautious and quick to take profits.

Last year I posted several times about 81$ being a price target for profits taking.

See:

http://cmd-chart.blogspot.com/2006/04/crude-oil-futures-cl-chart-update.html

http://cmd-chart.blogspot.com/2006/04/new-all-time-high-for-crude-oil-wti.html

http://cmd-chart.blogspot.com/2006/05/crude-oil-futures-wti-elliott-wave.html

WTI Crude oil contracts topped at July 2006 and broke below the five years uptrend line. Crude bottomed at January 2007 and currently we are witnessing some upside but the downtrend channel is still intact. It is still early to determine if the January bottom is significant or not , using the long term chart as guidance I estimate that a down spike to about 40$ is possible. The 62.5$ - 66$ seems like significant resistance for the March contract. As I see the situation traders should be cautious and quick to take profits.

Monday, January 15, 2007

Commodity Indices CRB vs. CCI Part 2

At September 2006 I have posted about an interesting divergence between the CRB and CCI commodity indices. The divergence has extended much farther and the CCI methodology have proved to be better (see the CCI & CRB weekly charts below), at least from for capital appreciation point of view. It appears that crude oil and crude oil derivatives commodities are weighted heavily in the CRB and other propriety indices.

Going forward commodities investors should be cautious as some commodities are at a point they can easily decline by up to 50%. It is my opinion that the commodities markets will be more difficult this year with increased divergence (between different commodities) and higher volatility.

Going forward commodities investors should be cautious as some commodities are at a point they can easily decline by up to 50%. It is my opinion that the commodities markets will be more difficult this year with increased divergence (between different commodities) and higher volatility.