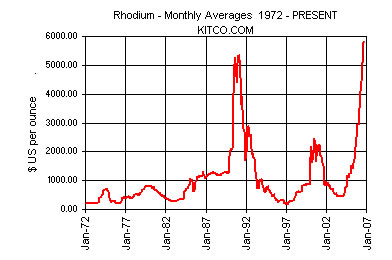

Rhodium arrows toward $7 000

19/05/2006 12:37 PM

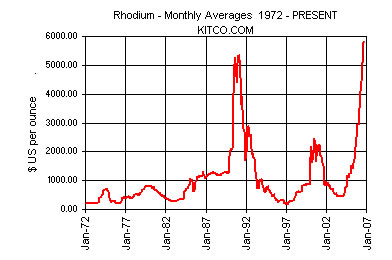

London - Rhodium jumped to a 26-year high on Friday due to endemic supply tightness, and prices look set to exceed 1980's all-time record of $7 000 an ounce soon.

Traders said an already tight market for rhodium, used in the manufacture of autocatalysts and in glass-making, was being squeezed further by speculators buying a metal that has jumped 105% this year.

"Definitely it will hit that historic high soon. How high can it go - who knows?" a trader said.

Spot rhodium was at $6 150/$6 250 an ounce, having sped higher from last week's $5 300/5 400 without interruption.

Apart from a mid-2000 price peak, rhodium has been in the doldrums for most of the last 25 years, trading as low as $190 in 1997.

Demand for LCD's

But demand is growing strongly, with plasma LCD (liquid crystal display) glass-makers the latest boom sector, and supply cannot keep up.

"It is quite simple, demand has been good for the last few years and stocks have been run down," another trader said.

Earlier this week top refiner Johnson Matthey, in its annual review of platinum metals, highlighted the strong fundamental picture as demand rose sharply during 2005, further outpacing supplies and widening the market's deficit.

"With demand for rhodium growing by more than twice the rate of increase in supplies, the market moved to a deficit of 58 000 ounces," Johnson Matthey said.

Consumption rose to 812 000 ounces in 2005, equalling the 2000 record, up from 2004's 729 000 ounces as use in autocatalysts, glass and chemical applications rose.

Supply rose by 5% to 754 000 ounces from 2004's 720 000, with South African output climbing 7% to 627 000 ounces. -

source