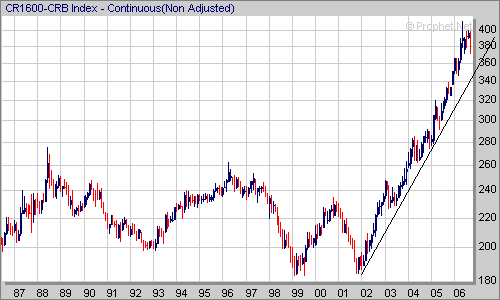

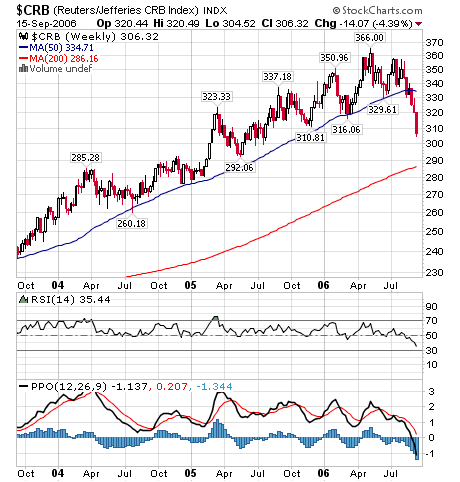

The “RJ/CRB” is an Index of 19 commodity futures prices, Commodity Research Bureau (CRB) Index was originally developed in 1957, continues to be one of the most often cited indicators of overall commodity prices.

Index Components (alphabetical order) :

1. Aluminum (6%)

2. Cocoa (5%)

3. Coffee (5%)

4. Copper (6%)

5. Corn (6%)

6. Cotton (5%)

7. Crude oil (23%)

8. Gold (6%)

9. Heating oil (5%)

10. Lean Hogs (1%)

11.Live cattle (6%)

12. Natural Gas (6%)

13. Nickel (1%)

14. Orange juice (1%)

15. Silver (1%)

16. Soy beans (6%)

17. Sugar (5%)

18. Unleaded Gas (5%)

19. Wheat (1%)

The New York Board of Trade (NYBOT) began trading the CRB in 1986; the name of the index changed to the Reuters CRB Index in 2001. Now again renamed and sponsored as the Reuters/Jefferies CRB Index..

The NYBOT also offers futures and options contracts on the Continuous Commodity Index (CCI) , representing the ninth revision (as of 1995) of the original Commodity Research Bureau (CRB) Index. The CCI Index consists of 17 commodity futures prices.

The RJ/CRB and CCI futures and options contracts, traded exclusively in the NYBOT index market place, offer investors direct access to an alternative asset class that may diversify their holdings.

For in dept overview regarding weighting factors adjustments and Index Chronology See

NYBOT.