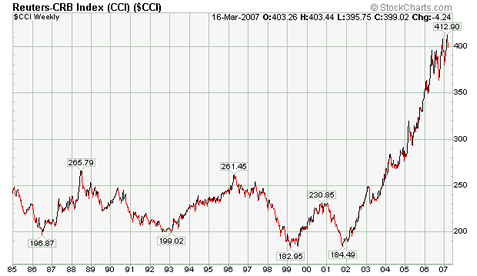

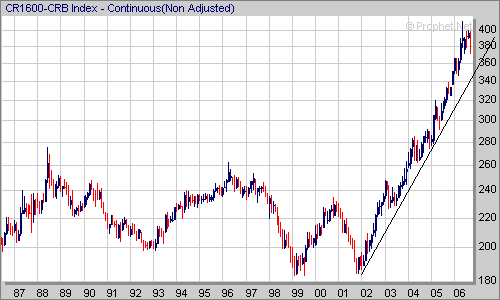

For all practical purposes the Continuous Commodity Index (CCI) is the preferred index for tracking the condition of the general commodities market. The reason for that is the way in which this index is calculated – The CCI Methodology.

5.88% for each of the 17 individual commodities included(

Energy 17.64% : WTI Crude Oil, Heating Oil, Natural Gas,

Grains 17.64% : Corn, Wheat, Soybeans,

Livestock 11.76% :Live Cattle, Lean Hogs,

Softs 29.40% : Sugar, Cotton, Coffee, Cocoa, Orange Juice,

Metals 23.52% : Gold, Silver, Platinum, Copper)

Here is the explanation of the CCI Methodology from the NYBOT:

The Continuous Commodity Index (CI)is weighted evenly among 17 component commodities. Each weighting is used for both arithmetic averaging of individual commodity months and for geometric averaging of the 17 commodity averages. With equal weighting, no single contract month or commodity has undue impact on the Index. The CCI uses a system of averaging all futures prices six months forward, up to a maximum of five delivery months per commodity. A minimum of two delivery months, however, must be used to calculate the current price if the second contract is outside the six-month window. Contracts in the delivery period are excluded from the calculation. Although each of the 17commodities is equally weighted, the CCI uses an average of the prices of the 17 commodities and an average of those commodities across time within each commodity. Each commodity is arithmetically averaged across time (the six-month window) and then these 17 component figures are geometrically averaged together. The continuous rebalancing provided by this methodology means the Index constantly decreases exposure to commodity markets gaining in value and increases exposure to those markets declining in value.